Ron Johnson has a long history of voting for regressive tax laws that benefit himself

Josh Israel

The Wisconsin Republican is one of the nation’s wealthiest senators, with an estimated net worth of more than $48 million in 2020.

A trust fund created by Wisconsin Republican Sen. Ron Johnson and his wife went from paying hundreds of thousands of dollars in taxes annually to the state of Wisconsin to contributing zero dollars a year since 2016, ABC News affiliate WKOW in Madison reported on Monday. This fits a long pattern by Johnson of trying to pay as little as possible in taxes.

Johnson’s campaign told WKOW that the fund was taking advantage of a state tax credit for manufacturing and agriculture and that he does not personally benefit from the account — though the trust fund reportedly purchased the $1 million Washington, D.C., home he stayed in after taking office in 2011, and charged him rent. According to WKOW, the trust fund still owns the house.

Johnson is locked in a tight reelection race against Democratic Lt. Gov. Mandela Barnes after breaking his promise not to seek a third six-year term.

He is one of the nation’s wealthiest senators, with an estimated net worth of more than $48 million in 2020. He has complained that his holdings have “gone up only double” since he became a senator.

“The stock market has gone up almost four times since I became a United States senator. So had I been invested heavily in the stock market I probably should’ve increased my wealth four times,” Johnson told a Wisconsin talk radio show in February. “The fact that I’ve gone up only double, I’ve way underperformed the market because I turned my marketable securities into cash so there could be no charges of conflict of interest. So I have no conflicts of interest.”

Johnson has previously come under fire for paying little in state and federal taxes.

In September 2021, the Milwaukee Journal Sentinel reported that he paid just $2,105 in state income taxes despite taking in a six-figure Senate salary and significant additional income. The story noted that a typical married couple with $40,000 in joint taxable income would have owed more than what Johnson paid.

In 2017, Johnson insisted on adding provisions to former President Donald Trump’s Tax Cuts and Jobs Act to cut taxes for pass-through entities, businesses that are taxed through the personal filings of the individuals who own them. This resulted in a handful of Johnson’s top campaign contributors saving millions of dollars on their federal tax bills.

Johnson, who owned a plastics company called Pacur, also saved a large chunk of money because of the Trump tax cuts.

“Now, did my business benefit? Sure. Did some of my donor businesses? Sure. When you give tax relief to everybody, everybody benefits,” he told supporters in April. “So they want to make it sound like I carved out some loophole for a couple of people. What I did is I made sure that 95% of American businesses weren’t left behind in tax reform. I’m really proud of that achievement.”

He has repeatedly said that he opposes any efforts to make millionaires like himself pay more.

He signed Grover Norquist’s Americans for Tax Reform pledge, vowing never to raise marginal income tax rates on individuals or businesses under any circumstances.

“People should be paying their fair share,” Johnson told WIBA radio in August 2021, but, he said, the wealthiest Americans are already paying “pretty close to their fair share.”

During an October 2021 telephone town hall, he told constituents: “The top 1% owns about 20% of the nation’s assets. But they pay 40% of the nation’s income tax. I mean, at some point in time, we got to go, ‘Well, it’s probably pretty close to a fair share.’ So I’m not into punitive taxation, I’m into fair.”

This misleading statistic does not include other federal taxes, such as payroll taxes for Social Security and Medicare, that are disproportionately paid by lower-income earners.

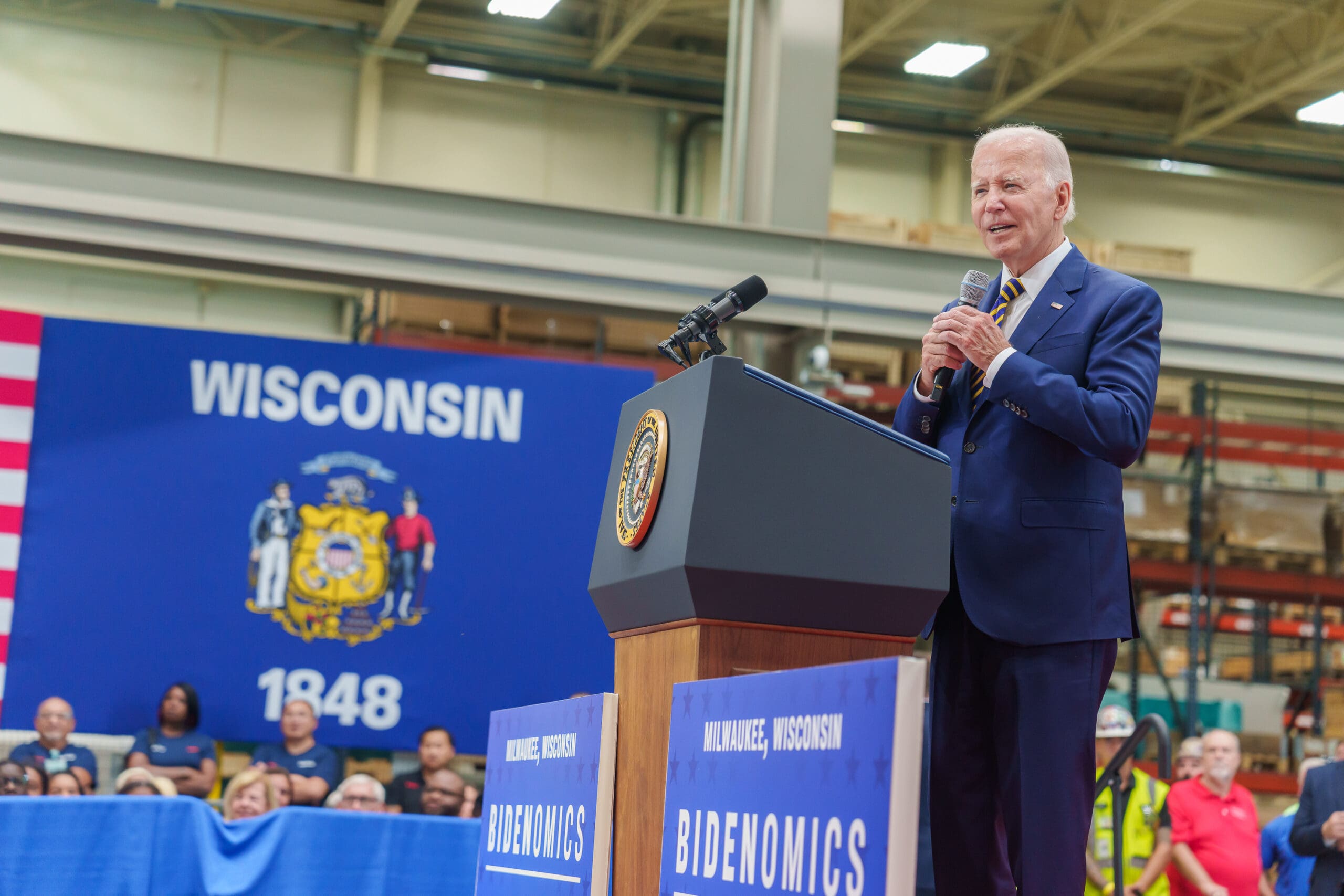

Johnson voted against President Joe Biden’s American Rescue Plan, which included an expanded 2021 child tax credit for families making under $440,000 annually.

“I’m not a fan of using the tax code for either economic or social engineering,” he tweeted at the time. “A flat tax structure, with no credits, would be much easier. But since we’re stuck with the current system, I want to make sure it’s administered fairly.”

Johnson has repeatedly called for a flat tax, which would eliminate deductions and exemptions, instead of the current progressive tax system. Experts say such a proposal would result in the richest Americans paying a lower share of the tax burden and middle-income families paying a lot more.

“No matter how a flat tax is structured,” noted a 2015 report by the progressive Center for American Progress, “the wealthy would always win.”

Johnson told Breitbart News Daily in April that he backs the bulk of National Republican Senatorial Committee Chair Rick Scott’s controversial “Rescue America” plan, which calls for a tax hike for the more than 100 million mostly retired and lower-income Americans who do not currently pay any federal income taxes, as well as for the expiration of safety-net programs such as Medicare and Social Security every five years.

“Do I agree with everything on it?” Johnson asked. “Most of it. I would have changes in certain things, but I think it’s a positive thing.”

Johnson’s campaign reelection site says that “he supports pro-growth tax reform and reducing burdensome regulations.”

The Johnson campaign did not immediately respond to an inquiry for this story.

“Ron Johnson thinks the wealthy should have one set of rules and working people should have another,” Democratic nominee Barnes said in a press releaseon Tuesday. “And while he rigs the tax code for himself and his wealthy donors, he’s standing in the way of the things that would help working people pay the bills like lower costs for prescriptions drugs and affordable health care.”

Published with permission from The American Independent Foundation.